Unlocking innovation in the financial sector can take time and effort. The industry constantly evolves, and companies must maintain a balance between fostering innovation and ensuring customer protection.

Unlocking innovation in the financial sector can take time and effort. The industry constantly evolves, and companies must maintain a balance between fostering innovation and ensuring customer protection.

From payments to robo-advising, fintech companies bring many new products and services. These innovative solutions challenge traditional finance and banking providers by being more nimble or serving an underserved population segment.

Mobile Payments

Mobile payments provide customers with many benefits as a mode of payment. They do not require a wallet or purse and are often quicker than traditional credit card transactions.

Mobile payments are also highly secure. Most smartphones have biometrics or a passcode, and encrypted data transmission makes it difficult for thieves to intercept a transaction.

Moreover, most mobile payment apps are linked to a formal bank account and operate on secure hardware. They are also integrated with other financial services, including P2P money transfers, savings, and loans.

New nonbank entrants such as Current do not immediately threaten banks in Europe and North America. However, their success depends on addressing consumer demands for advanced security and broad merchant acceptance. Additionally, they may seek to expand their m-wallet ecosystem with loyalty and other shopping-related services.

Peer to Peer Lending

Peer-to-peer lending cuts out the middleman and connects borrowers with lenders through online platforms. This offers individuals alternative financing options and is reshaping the financial industry.

While it can be attractive for investors due to its potential higher returns, it is essential to consider the risk factors. P2P lenders typically vet borrowers and ensure repayments are made by requiring them to provide their credit history and other details before they receive funding. Moreover, many of these loans are not covered by insurance, leaving you vulnerable to losses.

If you’re considering adding P2P lending to your investment portfolio, work with a financial advisor to analyze the pros and cons. They can help you identify the best borrowers and loans to diversify your portfolio and achieve your investment goals. Also, they can keep an eye on your portfolio so you can spot any potential issues and take quick action. This will maximize your return while mitigating the risks.

Financial Inclusion

People’s lives are improved, and development potential is unlocked through financial inclusion, enabling them to acquire and keep access to reasonably priced, efficient, and secure financial services. These services include savings, payments, credit, and insurance. They are essential to achieving important global development objectives like gender equality, job creation, and poverty reduction.

While great strides have been made in expanding formal financial services to the unbanked, 1.9 billion adults still need an account. Several factors limiting their ability to get an account include:

- Poor infrastructure and connectivity.

- There is a need for nearby banking or financial institution offices.

- Onerous documentation requirements.

Serving this market represents an immense opportunity from a business perspective. It also offers the potential to create better products tailored to consumers and meet their needs. A key factor for success is encouraging healthy competition. That means promoting a regulatory framework that allows providers to offer innovative products. It also means focusing on delivering value to customers by helping them save money, manage risks, and build resilience to shocks.

Transparency

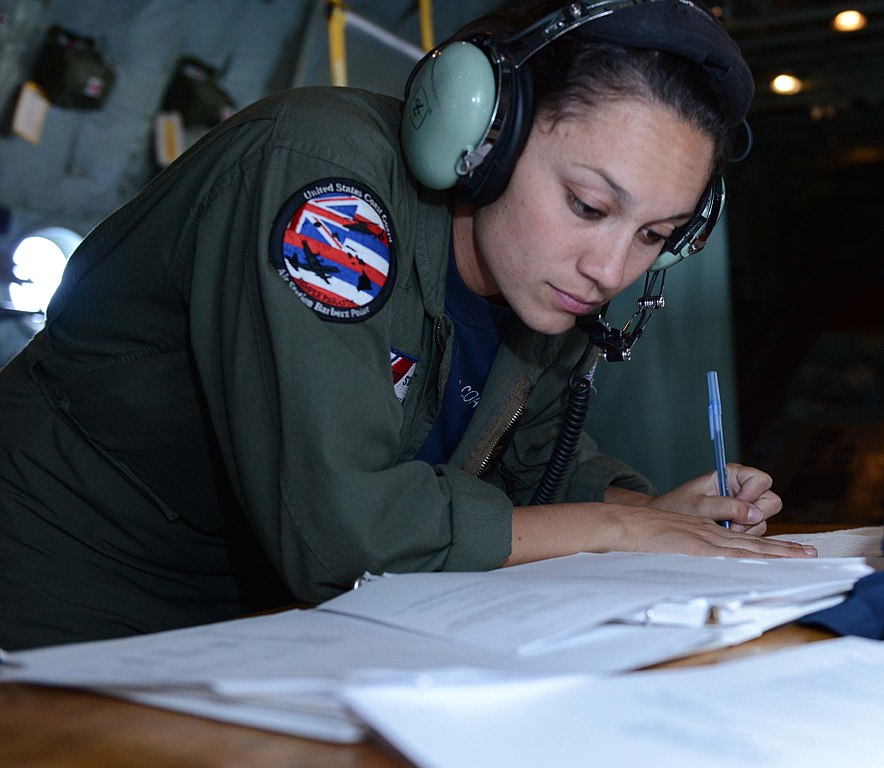

Transparency is an essential concept in the world of financial technology. It involves having transparent access to financial information, including a company’s audited financial reports. This transparency can help consumers and investors make more informed investment decisions.

One way to increase transparency in a company is to develop bottom-up solid communication channels. This will allow employees to share information about competitors up the chain of command quickly. It also helps prevent mistrust and confusion that can hamper a company’s ability to adapt to changes in the market.

An organization that prioritizes workplace openness stands to gain from the higher engagement and productivity results. Employees report feeling happy and productive at transparent companies, which can result in higher retention rates and a more profitable business.