Running a business comes with countless responsibilities, and one of the most important is protecting your company against unforeseen risks. Business insurance is a safety net that can safeguard your assets, employees, and reputation. However, choosing the right coverage can be a daunting task, given the variety of policies and options available. Here’s a step-by-step guide to help you select the insurance that best fits your business needs.

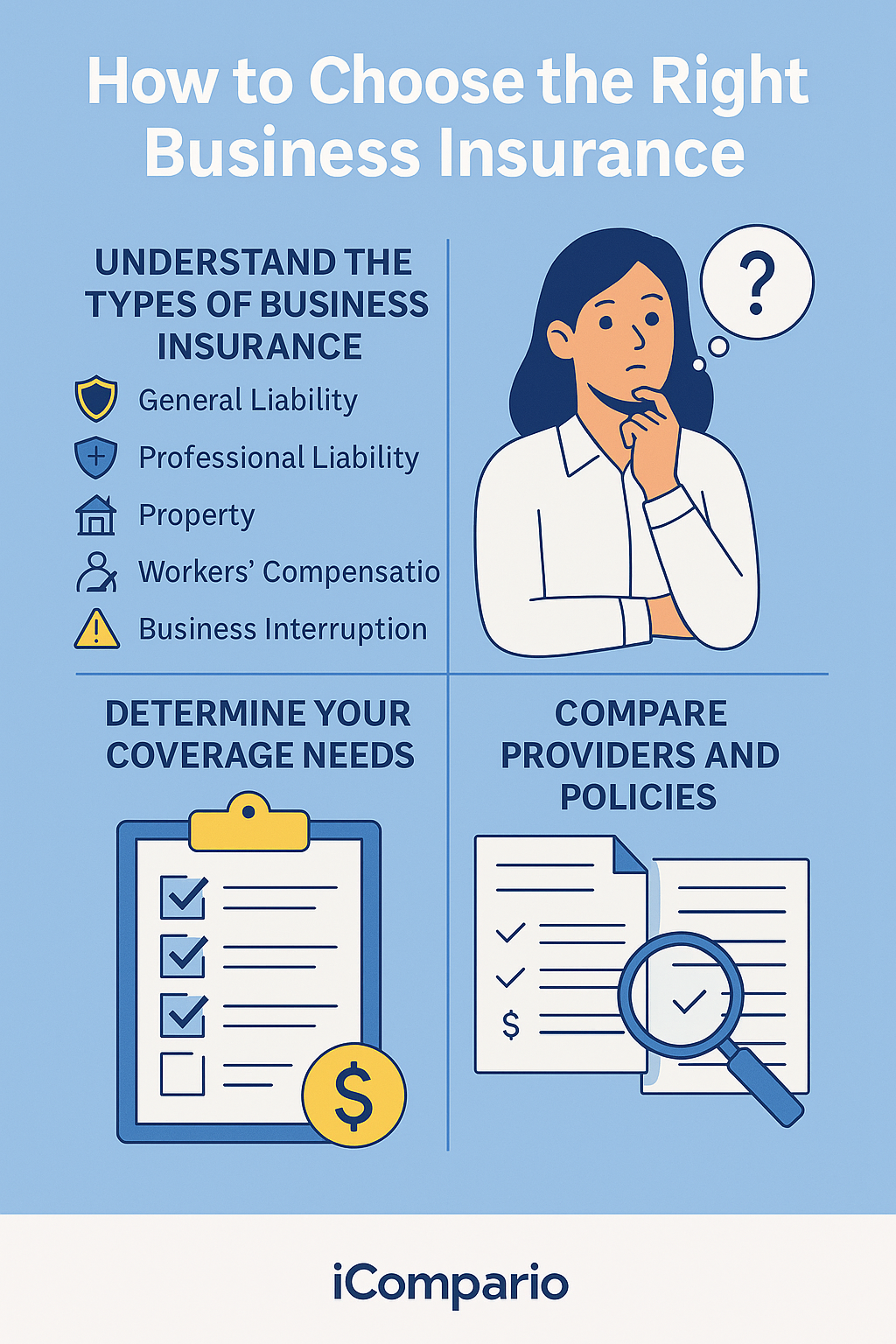

Understand the Types of Business Insurance

The first step in selecting the right business insurance is understanding the types of coverage available. Common options include:

- General Liability Insurance: Protects your business against claims of bodily injury, property damage, or advertising mistakes.

- Professional Liability Insurance: Also known as errors and omissions insurance, it covers negligence claims arising from professional services or advice.

- Property Insurance: Safeguards your physical assets, including buildings, equipment, and inventory, against risks such as fire, theft, or natural disasters.

- Workers’ Compensation Insurance: Provides benefits to employees who are injured on the job, including medical expenses and lost wages.

- Business Interruption Insurance: Helps cover lost income if your business operations are disrupted due to a covered event, such as a natural disaster.

Each business has unique risks, so it’s important to evaluate which types of insurance are most relevant to your operations.

Assess Your Risks

Every business faces different risks depending on the industry, location, size, and operations. Conducting a thorough risk assessment can help you identify potential exposures. For example, a retail store may prioritise property and liability insurance, while a consulting firm may focus more on professional liability. By understanding the specific threats your business faces, you can choose coverage that provides real value rather than paying for unnecessary policies.

Determine Your Coverage Needs

Once you know the types of insurance you need, the next step is to determine the level of coverage. Underinsuring can leave your business vulnerable to significant financial losses, while overinsuring can lead to unnecessary costs. Consider factors such as the value of your assets, the number of employees, potential legal liabilities, and the financial impact of business interruptions. Balancing adequate protection with cost-efficiency is key.

Compare Providers and Policies

Not all insurance providers are created equal. Different companies offer varying levels of service, policy terms, and claim processes. When comparing policies, pay attention to coverage limits, exclusions, deductibles, and additional benefits. Reading reviews and seeking recommendations can also provide insight into the reliability and responsiveness of insurers. A trusted comparison tool can simplify this process, allowing you to evaluate multiple options in one place, such as iCompario at https://www.icompario.com/en-gb/.

Consult with a Professional

Insurance can be complex, and making the wrong choice can have long-term consequences. Consulting with an insurance broker or agent can provide clarity, as they can tailor recommendations based on your specific needs and help you navigate policy details. Additionally, they can advise on any regulatory requirements for your industry, ensuring your business remains compliant.

Review and Update Regularly

Your business will evolve over time, and so will your insurance needs. It’s important to review your policies regularly and update them to reflect changes such as business expansion, new products or services, or additional employees. Regular reviews help prevent coverage gaps and ensure your business remains adequately protected.