The Rising Demand for Animal Mortality Coverage

In today’s rapidly evolving landscape of agriculture, animal husbandry, and pet ownership, awareness is growing among those responsible for animal welfare and asset protection. Whether it’s a small farm with livestock, a dedicated equestrian center, or a passionate pet owner, the financial and emotional stakes of animal loss have never been clearer. The need for animal mortality insurance has grown as clients realize traditional insurance often leaves critical gaps unaddressed.

Recent trends in both the agricultural and equine markets underscore this shift. Market volatility, changing weather patterns, and evolving disease risks put significant pressure on those who rely on animals for their livelihood or companionship. Farms, individuals, and businesses are increasingly seeking specialized insurance products to protect against unpredictable losses that can disrupt operational stability or compromise family well-being.

What Is Animal Mortality Coverage?

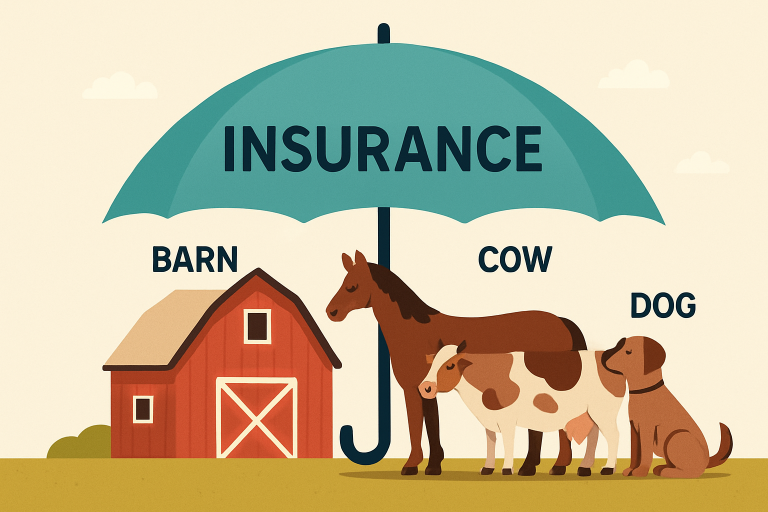

Animal mortality coverage is designed to mitigate the financial consequences of losing animals due to causes such as illness, accidents, or unavoidable disasters. Unlike generic property or liability coverage, these policies are specifically tailored to address the unique vulnerabilities of livestock, horses, zoo animals, or pets. Common policyholders include farms concerned with herd health, equestrian centers managing high-value steeds, zoos protecting endangered species, and households seeking peace of mind for their beloved pets. The main risks addressed range from contagious diseases and accidental injuries to severe weather events and theft. According to Investopedia, animal mortality insurance provides financial protection against these types of losses.

As these risks become better understood and more widely publicized, the appetite for tailored solutions grows. Owners and managers expect robust risk transfer tools to complement biosecurity and animal health initiatives, ensuring that the loss of a single animal or an entire group does not trigger prolonged financial hardship.

Common Gaps in Standard Insurance Offerings

Traditional property and casualty insurance is often ill-equipped to cover the nuanced exposures around animal ownership. Many standard policies exclude animals as insurable property or offer only nominal compensation for specific incidents. For example, a farm’s barn may be protected against fire, but the animals housed within might not be. Likewise, a boarding stable’s general liability policy may not compensate an owner for the accidental death of a client’s horse.

Clients frequently encounter coverage gaps such as a lack of protection for disease outbreaks, a limited scope for accidental injuries, or no recourse in the event of theft or legal destruction of animals. These challenges highlight the necessity of specialized policies that consider not only the species and intended use but also the economic and sentimental value of the animals insured.

How Insurers Identify And Assess Client Needs

Insurers committed to providing effective animal risk solutions begin with comprehensive risk assessments. This includes evaluating the client’s animal inventory, breed values, prevailing health threats, and operational protocols. Understanding the role and value of animals—whether as a critical source of income, a competitive equine athlete, or a cherished companion—guides coverage recommendations and policy structure. Collaboration is central to this process. Insurers work closely with veterinarians for accurate health evaluations, with brokers for market insights, and with underwriters for precise policy terms and conditions. By gaining a 360-degree view of client needs and risks, insurance providers can design offerings that precisely fill coverage gaps.

Strategies For Bridging Coverage Gaps

- Offering add-ons or endorsements to standard policies: Insurers can expand existing products by introducing mortality-specific endorsements for animal owners, whether they’ve invested in champion show dogs or a flock of sheep.

- Partnering with specialty markets: By aligning with insurers focused on animal mortality risk, agents and brokers gain access to comprehensive solutions that are not available in off-the-shelf products.

- Policyholder education: Leveraging targeted educational resources helps clients understand their vulnerabilities and available options, empowering them to make informed decisions about their insurance.

Industry Trends and Future Directions

Changes in climate and the increasing incidence of emerging animal diseases are intensifying demand for comprehensive mortality coverage. Recent years have seen an increase in extreme weather events and the emergence of new disease vectors, putting new types of animals and businesses at risk. Simultaneously, advances in animal welfare and ethical husbandry are shaping expectations about what insurance should cover—and how claims are managed. Innovation is also accelerating in risk assessment. Integrating data analytics, remote health monitoring, and digital reporting tools enables insurers to more accurately assess exposures and respond more quickly to claims.

Conclusion

The growing demand for animal mortality coverage reflects a broader recognition of the financial and emotional significance of animals in agriculture, equine pursuits, and pet ownership. Traditional insurance often falls short in addressing these unique risks, leaving owners exposed to potentially devastating losses. By understanding client needs, identifying coverage gaps, and leveraging specialized policies and partnerships, insurers can offer tailored solutions that protect both livelihood and investment. Real-world examples demonstrate how timely mortality coverage mitigates financial disruption and supports recovery, while ongoing industry trends and technological advancements continue to shape more effective and responsive risk management strategies. Ultimately, animal mortality insurance has become an essential tool for safeguarding the well-being of animals and the stability of the businesses and households that rely on them.