Establishing a robust financial foundation is essential for nonprofits seeking to make meaningful, lasting impacts in their communities. Achieving sustainable success requires strategic planning, prudent decision-making, and a willingness to adapt to ever-changing financial landscapes. One critical aspect of this framework is ensuring transparency through procedures such as nonprofit audits, which help maintain integrity and trust among donors and stakeholders.

Nonprofits face unique financial challenges, from inconsistent funding cycles to sudden changes in donor priorities or economic conditions. By focusing on stable revenue generation, cash flow management, and organizational development, nonprofits can navigate these obstacles more effectively. Effective financial management is not just about safeguarding resources it’s about empowering teams, building community trust, and advancing a mission.

The strategies outlined below are designed for nonprofits at all stages of growth, offering actionable steps to ensure long-term financial resilience and mission-driven success. Implementing these practices will position organizations to weather financial uncertainties, seize new opportunities, and maximize their impact in the communities they serve.

As financial demands continue to evolve, proactive planning and modern tools such as technology integrations can significantly enhance effectiveness. Success stories from organizations that have embraced these principles continue to demonstrate the transformative potential of sound financial practices.

Diversify Revenue Streams

Financial resilience begins with a diversified stream of income sources. Relying heavily on one grant or a single annual event can expose an organization to significant risk if those funds suddenly disappear. Consider creating multifaceted fundraising campaigns, establishing relationships with individual donors, seeking corporate sponsors, and developing meaningful earned-income programs, such as training workshops or product sales.

- Individual Giving Programs: Engage with supporters year-round through personalized communications and stewardship initiatives, building a loyal donor base that contributes reliably.

- Corporate Partnerships: Seek strategic collaborations with businesses whose values align with your cause. These partnerships can yield monetary contributions and valuable in-kind resources.

- Earned Revenue: Explore fee-for-service models or mission-aligned product sales. Not only do these avenues support financial flexibility, but they also often deepen community connections.

- Multi-Year Grants: Prioritize applications for long-term funding to buffer against revenue fluctuations and foster better program planning.

Nonprofits with diverse revenue streams exhibit greater financial resilience and are better able to respond to challenges and opportunities.

Implement Effective Cash Flow Management

Even with diversified income, nonprofits need to ensure they have cash available when needed. Careful cash flow monitoring prevents operational interruptions, such as missed payrolls or program delays, which can erode credibility and effectiveness. Conduct regular financial reviews to identify upcoming cash gaps or surpluses and make adjustments as required.

- Regular Financial Monitoring: Monthly reviews of income and expenditures help quickly detect issues and capitalize on positive trends.

- Budget Forecasting: Account for expected revenue swings by considering seasonal giving patterns or grant award schedules in your annual budget planning.

- Emergency Funds: Set aside a percentage of annual income to address unexpected expenses or funding delays, creating a critical safeguard for operations.

Strong cash flow management ensures program continuity and builds organizational resilience, especially during funding delays.

Invest in Staff and Board Development

Skilled staff and an informed board are indispensable to effective financial oversight. Investing in targeted professional development creates an organization that not only adapts to challenge but also drives innovation. Ongoing training in financial management, programs, and governance is essential to organizational health.

- Professional Development: Offer stipends or access to seminars on nonprofit finance, leadership, and technology.

- Board Training: Provide strategic planning sessions and governance workshops to ensure board members understand their fiduciary duties.

Empowering your team through learning opportunities builds institutional knowledge and supports a culture of continuous improvement.

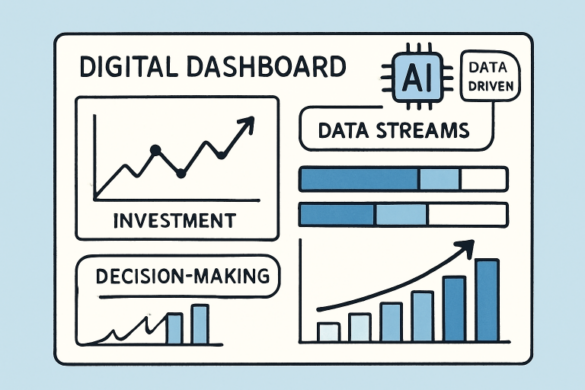

Leverage Technology for Financial Efficiency

The right financial technology tools can dramatically enhance efficiency and accuracy. Modern accounting platforms, fundraising CRM systems, and budgeting software allow nonprofits to automate reporting, generate real-time insights, and reduce manual errors. This digital transformation frees up valuable staff time for mission-centric activities.

- Automated Reporting: Simplify compliance with funders and internal stakeholders by generating detailed, accurate financial reports quickly.

- Real-Time Insights: Make informed decisions with up-to-date dashboards tracking all aspects of organizational finances.

Organizations adopting cloud-based financial management systems report fewer administrative burdens and greater organizational agility.

Establish an Operating Reserve

Creating an operating reserve provides a financial buffer against unforeseen challenges or opportunities. Begin by determining how many months of expenses your organization should cover; generally, three to six months is recommended. Then, establish a policy for growing and using that reserve. Clear usage guidelines help ensure funds are available for true emergencies and not routine shortfalls.

- Determine Reserve Size: Assess organizational risk factors and set a goal that reflects your unique operating environment.

- Develop a Funding Plan: Allocate a portion of annual surpluses to steadily grow your reserve.

- Set Usage Policies: Document when and how the reserve can be accessed to avoid inappropriate use.

Enhance Financial Transparency

Transparency builds trust with donors, funders, and the public. Sharing regular, easy-to-understand financial reports either via annual reports or updates to your website demonstrates responsible stewardship. Open communication with supporters about financial goals and challenges helps strengthen organizational credibility.

- Regular Financial Reporting: Produce clear annual reports with outcomes and impact statements.

- Open Communication: Keep stakeholders informed about financial challenges and achievements.

Prioritizing transparency can result in stronger relationships and repeat giving.

Engage in Strategic Planning

Strategic planning aligns resources and actions to further the mission. Develop clear, measurable financial objectives and revisit them regularly. Utilize SWOT analysis to identify and manage risks, and adjust plans as conditions change. Continuous review ensures your financial strategies remain relevant and mission-driven.

- Set Clear Objectives: Develop quantifiable goals, such as increasing unrestricted reserves or expanding earned-income programs, within defined timelines.

- Conduct SWOT Analysis: Analyze internal and external factors affecting financial stability and growth.

- Review and Adjust: Schedule regular board or leadership check-ins to evaluate progress and adapt to new challenges or opportunities.

Foster Strong Donor Relationships

Loyal donors are the backbone of most successful nonprofit organizations. Consistent, personalized engagement—thanking supporters, sharing impact stories, and offering opportunities for participation keeps your mission top of mind. Demonstrating the tangible impact of their gifts encourages recurring and increased support.

- Personalized Communication: Tailor messages to donor interests and recognize each individual’s contributions.

- Demonstrate Impact: Share compelling stories and data on the difference their donations make.

- Offer Engagement Opportunities: Host special events or invite donors to join volunteer activities to deepen their connection to your cause.

By committing to these strategies, nonprofits can establish a strong financial foundation that fuels ongoing mission achievement and cultivates community trust.